Cardozo, noted that the key focus of the meeting was to achieve price stability by using tools available to curb the inflation.

The CBN boss, who is also the MPC Chairman, said the inflation pressure was being driven largely by food inflation, citing rising costs of transportation, infrastructure challenges, insecurity, and exchange rate issues as some of the factors affecting it.

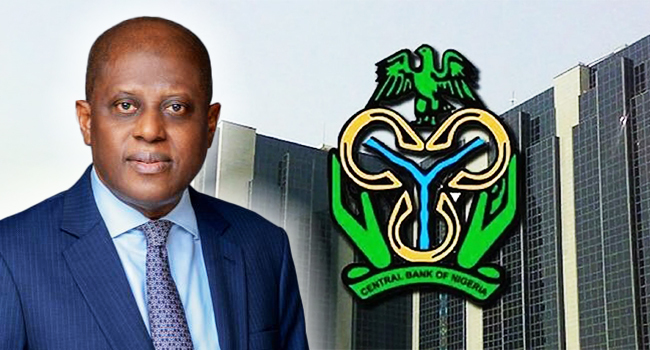

Cardoso said: “The Monetary Policy Committee (MPC) of the Central Bank of Nigeria (CBN) held its 295th meeting on the 20th and 21st of May 2024 to review recent economic and financial developments and assess risks to the outlook,” Cardoso who is also the MPC chairman said on Tuesday.

“Decisions of the MPC. The committee’s decisions are as follows: 1. Raise the MPR by 150 basis points to 26. 25 per cent from 24.75 per cent.”

He, however explained that the MPC retained the Cash Reserve Ratio (CRR) of Deposit Money Banks (DMBS) at 45 per cent.

The MPC also put the Asymmetric Corridor around the MPR at +100 and –300 basis points. It retained the liquidity ratio at 30 per cent.